January 11

One of the features of traveling as I do is that each day brings incredible opportunities to do spectacular and frequently new things. Sometimes these opportunities are, literally, opportune. That happened our first night in Hanoi when the only non-business professor, who is in awe of this program’s locations because we’re in the Club area (I could get used to being pampered, as we are; there’s a separate lounge for a “happy hour” that was so good we didn’t have dinner Friday night), and I went for a walk around Westlake, where we’re staying at the Sofitel. (PS — The pool has a retractable dome). The main way Americans might know about Westlake is that  John McCain was shot down here in 1969, and there’s a monument to the heroic citizens who defended Hanoi against the foreign invaders.

John McCain was shot down here in 1969, and there’s a monument to the heroic citizens who defended Hanoi against the foreign invaders.

Anyway, Professor Berman wanted to find a high school near here that apparently attracted the cream of Vietnamese society, and turned them into good revolutionaries against the French. We walked across the lake, where he thought the place was; he speaks sometimes passable Vietnamese (as I told Carolyn, I enjoy watching him interact because the Vietnamese usually look at him the way the Chinese look at me when I attempt to speak Chinese – befuddled as to what language is being spoken).

We finally found a coffee shop where he engaged someone who understood, and told him it was far away, so we went into the shop for chocolat chaud (hot cocoa). He spotted a photograph that he decided he “had to have,” because it was similar to a lacquered painting he had purchased last fall when he was teaching in Hanoi. One thing led to another, and it turned out that the photographer was the uncle of the cafe owner, and would we like to meet him? Next thing we know, we’re going two doors down (past the black and white cafe, in case you’re wanting to follow in our footsteps) into the photographer’s apartment, where we were treated to his wonderful portfolio (I bought one) and a conversation, in halting English and halting Vietnamese into his life; it was neat just to see his apartment.

The next day was planned opportunity, and in fact the past two days – the weekend here before Tet, the New Year – people were enjoying the

outstanding weather and doing their shopping for the holiday, which essentially shuts down the country for a week. We were scheduled to visit Ha Long Bay, a world heritage site that had escaped me in 1995 for reasons that now escape me. We had a choice – whether to spend overnight on the bay (shades of the seabase) or do a looong one day trip; the one day trip advantage was that Sunday we would have a city tour of Hanoi, otherwise we’d get back mid-day. I opted for the day trip.

outstanding weather and doing their shopping for the holiday, which essentially shuts down the country for a week. We were scheduled to visit Ha Long Bay, a world heritage site that had escaped me in 1995 for reasons that now escape me. We had a choice – whether to spend overnight on the bay (shades of the seabase) or do a looong one day trip; the one day trip advantage was that Sunday we would have a city tour of Hanoi, otherwise we’d get back mid-day. I opted for the day trip.

Ha Long Bay is famous for the karst scenery (like well-known Guilin in China); it’s developed into a tourist site par excellence, with dozens of boats hustling thousands (it seemed) of tourists (this is a good time to go to Australia, I think; down under is up over – i.e., they’re here!) If you want to know what the bay looks like, I’ll try to send a photo with this, and if that doesn’t work, check out Indochine with Catherine Deneuve, which is a sumptuous film reflecting the French nostalgia for a colony it lost a half century ago.

We went out to a cavern discovered in 1994, which is to say it was not trashed at all, and sailed the bay for a few hours and then came back to Hanoi. The road was decent, the traffic indecent, and the only major difference I saw to compare our Northern trip (708 miles to Saigon) with the South was that up here there were fewer churches and pagodas along the road. We spent today in the city of Hanoi, which I had remembered as one of the most European cities in Asia. In fact, as we drove past one building, I remarked that I’d seen it in Bucharest last summer, and wondered where it would follow me in the future.

With the French city attempting to resemble Paris (as the late 19th century European cities also did), there were remnants of France’s 150 years of rule throughout the city. The old quarter, by contrast, reflects the fact that Hanoi has been on and off the capital of countries here for nearly a thousand years; in fact, if you’re here 10/10/10, you’ll be able to join the celebration of 1,000 years of the history of Hanoi. Supposedly one of the kings of the Ly Dynasty took a boat trip on the Red River (which I can see from my window) and saw a dragon ascending; it was so auspicious he moved the capital here. I have no independent verification, and I was not around at the time! Honest.

The places we toured today reflect the tortured history of the country, which is located in an area my son David has dubbed the Balkans of Asia. There are monuments to the heroes who fought the Chinese, including two ladies who mustered a defense of the country (as late as 1979, the Chinese have attempted to cross the border here, and eventually got sent packing); there are monuments to the Vietnamese hero who stopped the Mongols (perhaps the only peoples to do so); I thought the Christian armies led by Hungary turned back the Mongols at Budapest, but someone told me that the death of Genghis Khan called off the attack as the chieftains had to return to Mongolia to vote for his successor. (In fact we stopped yesterday at a cemetery for soldiers and met a woman whose brother had died in the Vietnamese liberation – certainly appropriately applied in this case – of Cambodia from the Khmer Rouge – the Killing Fields bunch – in 1978 or so. A book I saw is entitled roughly, Vietnam at War, 1854-1980.

As you might expect, many of the museums and monuments deal with three topics: Ho Chi Minh, the “French War,” and the “American War.” Ho Chi Minh was the first president of Vietnam, and the inspiration for its liberation from the French and ultimate reunification, although he died before the end of the war. His mausoleum houses his embalmed body, embalmed by the same Eastern Europeans who did Lenin and Mao. It’s a solemn place, with the “Ho Chi Minh” mall a respectable distance away, unlike the similar mausoleum for Mao. Uncle Ho is everywhere, sort of like George Washington – in public places, on propaganda billboards and sayings, etc.

As you might expect, many of the museums and monuments deal with three topics: Ho Chi Minh, the “French War,” and the “American War.” Ho Chi Minh was the first president of Vietnam, and the inspiration for its liberation from the French and ultimate reunification, although he died before the end of the war. His mausoleum houses his embalmed body, embalmed by the same Eastern Europeans who did Lenin and Mao. It’s a solemn place, with the “Ho Chi Minh” mall a respectable distance away, unlike the similar mausoleum for Mao. Uncle Ho is everywhere, sort of like George Washington – in public places, on propaganda billboards and sayings, etc.

The other wars are memorialized either in buildings or in the museums. In most cases, the new emperors replace the old, but in 1954, when the French surrendered Vietnam (temporarily dividing the country awaiting an election for unification that never happened), Ho refused to move into the palace that had been the home of the governor general of Indochine; he said it was too rich for a poor country, and lived in cottages on the grounds until he built a very modest stilt house that visitors still traipse through. The palace is now a guest house for foreign dignitaries.

The other wars are memorialized either in buildings or in the museums. In most cases, the new emperors replace the old, but in 1954, when the French surrendered Vietnam (temporarily dividing the country awaiting an election for unification that never happened), Ho refused to move into the palace that had been the home of the governor general of Indochine; he said it was too rich for a poor country, and lived in cottages on the grounds until he built a very modest stilt house that visitors still traipse through. The palace is now a guest house for foreign dignitaries.

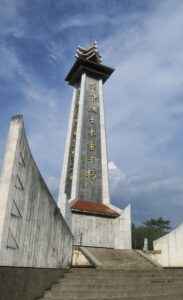

As for the war museums, I went to one that features an enormous diorama of Dien Bien Phu, the big battle in Northwest Vietnam where, in 1954, the French lost so badly they called “Uncle” (Ho). On its grounds are remnants of the fort the Vietnamese built in 1804, an arsenal tower that is the symbol of the City. There’s a sculpture of parts from American planes shot down during the Vietnam war that’s about 40 feet high, and guns captured from armies from the mid 19th century on.

As for the war museums, I went to one that features an enormous diorama of Dien Bien Phu, the big battle in Northwest Vietnam where, in 1954, the French lost so badly they called “Uncle” (Ho). On its grounds are remnants of the fort the Vietnamese built in 1804, an arsenal tower that is the symbol of the City. There’s a sculpture of parts from American planes shot down during the Vietnam war that’s about 40 feet high, and guns captured from armies from the mid 19th century on.

We also visited a few sites that demonstrate that while, as one of our speakers noted, Vietnam is not a small China for business, the country is indebted culturally to China. One of my favorite places is the “Temple of Literature,” which is a Confucian Temple. Vietnam instituted Confucian exams and until missionaries transliterated the language using an alphabet, used the Chinese characters. In the temple is a statue of the Great Sage, and names of the scholars who passed the examinations to become mandarins

(

( none of your names were on it – I checked!) Having been to the Confucian in Beijing, Seoul, and in Confucius’ hometown of Qufu, I know a Confucian temple without any confusion (It’s getting late!)

none of your names were on it – I checked!) Having been to the Confucian in Beijing, Seoul, and in Confucius’ hometown of Qufu, I know a Confucian temple without any confusion (It’s getting late!)

Finally, we saw the “one pillar” temple, which is another symbol for Hanoi. Built early in the Ly Dynasty, it’s an obvious example of East Asian (rather than South Asian) Buddhism – the earthy colors rather than the gold and cut glass of Thailand, marking Vietnam’s ties with its northern neighbor. Inside is the Goddess of Mercy, (who became a woman in China, but not in India or SE Asia), making the site a popular one for women seeking boy children.

One transition to the next blog – I spent the late afternoon with the father of one of my IWU students, and tomorrow evening I’m visiting with his family. He pointed out that his family had pitched in to send his son to the United States, another example of Confucian society – but that’s for tomorrow, when I go back to “work.”

hiking one of the trails (with a sign that said, “Be off the trails from 6 p.m. until 8 a.m. because that’s when the elephants use them) when armed guards blocked us from going further because there was a herd of elephants on the prowl. Because they have poor eyesight and can become enraged, the park wants to keep people away from them. The best way to see the herd is from a funicular, which was not running. As I told the guide, if you want to be sure of seeing elephants, go to the zoo. He’s been to the park 100 times and seen them twice from the gondola.

hiking one of the trails (with a sign that said, “Be off the trails from 6 p.m. until 8 a.m. because that’s when the elephants use them) when armed guards blocked us from going further because there was a herd of elephants on the prowl. Because they have poor eyesight and can become enraged, the park wants to keep people away from them. The best way to see the herd is from a funicular, which was not running. As I told the guide, if you want to be sure of seeing elephants, go to the zoo. He’s been to the park 100 times and seen them twice from the gondola. As a bonus, the lake in the park had a zip line, which, for a fee, enabled me to get across quickly; there was a cameraman at the other end, who, for a fee, provided me with a souvenir (for about $1.20, I have a 5×7 laminated picture with a Chinese inscription telling the where and the date. I told you the tourist infrastructure was quite well developed!). They have the picture-taking services everywhere; at the bird exhibit in the Wild Elephant Valley, a trained parrot swoops to you if you hold your hand out, and you can have a picture of that, too!

As a bonus, the lake in the park had a zip line, which, for a fee, enabled me to get across quickly; there was a cameraman at the other end, who, for a fee, provided me with a souvenir (for about $1.20, I have a 5×7 laminated picture with a Chinese inscription telling the where and the date. I told you the tourist infrastructure was quite well developed!). They have the picture-taking services everywhere; at the bird exhibit in the Wild Elephant Valley, a trained parrot swoops to you if you hold your hand out, and you can have a picture of that, too! most interesting business opportunities came from a man who in a 1995 movie played Chiang Kai-shek. For 30 renminbi you could take a picture with him. I pondered it and decided that having a picture with him in front of the sign that touted the merits of the picture might be nice for my marketing class. I bargained one picture on my camera for ten renminbi. He agreed, put on his military uniform (he did look like the generalissimo), and my guide took a picture. The man then assumed another position when I handed him the bill, and suggested another picture (one with me bribing him?), for which he then demanded another 10 RMB. I think maybe he had studied the part too well.

most interesting business opportunities came from a man who in a 1995 movie played Chiang Kai-shek. For 30 renminbi you could take a picture with him. I pondered it and decided that having a picture with him in front of the sign that touted the merits of the picture might be nice for my marketing class. I bargained one picture on my camera for ten renminbi. He agreed, put on his military uniform (he did look like the generalissimo), and my guide took a picture. The man then assumed another position when I handed him the bill, and suggested another picture (one with me bribing him?), for which he then demanded another 10 RMB. I think maybe he had studied the part too well.