Greece lost its marbles—and we found them (read further to find the explanation of this mystery)

London, May 10, 2013

Day 3 in London was a nice mix of activities, with the extra of having most of the afternoon and evening free to explore. What I’m going to share was my day, part of which involved our students.

In the morning we took the underground (the subway is an underpass here) to visit Citi’s operations in London, a visit facilitated by former student (and veteran May term tripper—he went to Asia with me a few years ago) Chris Wheatley, who is completing an internship in “private banking.”

Chris  invited two of his coworkers (boss?), who described the nature of private banking to us. As they explained, they provide customer services to a limited clientele—the really wealthy in Europe, the Middle East, and Africa (from this area), with a heavy emphasis on benefitting “cash rich” customers.

invited two of his coworkers (boss?), who described the nature of private banking to us. As they explained, they provide customer services to a limited clientele—the really wealthy in Europe, the Middle East, and Africa (from this area), with a heavy emphasis on benefitting “cash rich” customers.

The bank has 25 bankers who handle about 15 or so clients, providing advice and management services such as through a jet aircraft division (so the owner doesn’t have to worry about what to buy, how to maintain, etc.), or brokering deals such as the purchase of a sports team and the building of a stadium (the 30 something banker told us he doesn’t know why, but when you get a certain level of financial security, you want to buy a team–witness the Russian owner of the Nets). The key is not only to provide a portfolio of services, but to build a personal relationship (he hosted a $1 million golf tournament), taking what is in many ways a commodity business and moving farther downstream into customer service. They pointed out that England is an important base because of the stability of the country, economically and politically, as well as the desirability of the wealthy to have a home in London.

One of the interesting challenges they described was the political vulnerability of (and the press attacks on) banks in Europe. The Europeans have limited the size of bonuses that can be awarded to bankers, a policy that has been followed in the United States. From what we saw, though, Citi is at least as much a local, global bank as the Hong Kong and Shanghai Bank which has claimed that slogan as its own.

Similar to what we heard yesterday at Cisco, and in the evening from Professor Pana and my two students who are working in finance in London, banking is a competitive business in England. As a result of the financial  crisis of the past few years, there are about 250,000 finance people in England, down from 350,000 at the onset of the crisis. In describing how to get through the barrier, they emphasized the study of foreign languages—everyone in Europe seems to know several, and some of the Universities in England pay for their students to study abroad for a year—and to “network like crazy; make every connection count.”

crisis of the past few years, there are about 250,000 finance people in England, down from 350,000 at the onset of the crisis. In describing how to get through the barrier, they emphasized the study of foreign languages—everyone in Europe seems to know several, and some of the Universities in England pay for their students to study abroad for a year—and to “network like crazy; make every connection count.”

Now for the lost marbles. After lunch, we went to the close by British Museum, and like many museums in England (but not much else), with free admission. Westminster Abbey was about 18 L by contrast. The reason was to make sure the students got to see the so-called “Elgin Marbles,” the  friezes that Lord Elgin, as British ambassador to Turkey (another connection for the trip), brought back with the consent of the Turkish governor of Greece to England, and they eventually wound up in a room in the British Museum. The storyline is roughly that the Ambassador’s actions saved the frieze from pollution and neglect, and possible destruction, which I’ll bet is not the same story we’ll get in Athens, which has requested the purloined pieces be sent back to Athens to be reunited in the Acropolis Museum. We’ll get to see the remaining 30% that are in Athens later.

friezes that Lord Elgin, as British ambassador to Turkey (another connection for the trip), brought back with the consent of the Turkish governor of Greece to England, and they eventually wound up in a room in the British Museum. The storyline is roughly that the Ambassador’s actions saved the frieze from pollution and neglect, and possible destruction, which I’ll bet is not the same story we’ll get in Athens, which has requested the purloined pieces be sent back to Athens to be reunited in the Acropolis Museum. We’ll get to see the remaining 30% that are in Athens later.

Students scattered after that, while Ella and I sampled some of the other areas of the museum. There’s a fabulous Egyptian collection (remember Great Britain was the “protector” of Egypt as part of the digging of the Suez  Canal; and the creator of the Cairo museum that has the King Tut relics), a substantial Greek collection (again, it was Hellenophiles such as Lord Byron, that helped in the war of independence that freed Greece from Turkey in the 1820s), with a selection from Cyprus that would have pleased Professor Pana’s Cypriot husband; a nice collection of Indian Buddhist/Jain artifacts, though smaller than I would have expected (and not much from the East India Company that triggered the British raj), and the usual assortment of Chinese and south east Asian materials, including items from many of the ruins I’ve seen—the Mogao caves, the Lungmen grottos, Borobudur and Prambanan in Indonesia, and some nice shamanist Buddhas from Tibet.

Canal; and the creator of the Cairo museum that has the King Tut relics), a substantial Greek collection (again, it was Hellenophiles such as Lord Byron, that helped in the war of independence that freed Greece from Turkey in the 1820s), with a selection from Cyprus that would have pleased Professor Pana’s Cypriot husband; a nice collection of Indian Buddhist/Jain artifacts, though smaller than I would have expected (and not much from the East India Company that triggered the British raj), and the usual assortment of Chinese and south east Asian materials, including items from many of the ruins I’ve seen—the Mogao caves, the Lungmen grottos, Borobudur and Prambanan in Indonesia, and some nice shamanist Buddhas from Tibet.

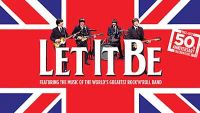

Professor Pana and I—and one of our students—did get that Indian meal, but our professorial goal afterwards was to sample one of the evening cultural activities in London. The Royal Opera (Don Carlo by Verdi was sold out); I’ve seen the English National Opera production of La Boheme, and Helen Mirren’s The Audience has nary a seat left for the entire run. Thinking what could be more British than the Beatles (and remember I love classical music—1690s or 1960s), we decided on “Let it Be,” a 2 hour  look at the Red/Blue and #1 albums of the Beatles, interspersed with film clips and commercials from the six or seven years of Beatlemania.

look at the Red/Blue and #1 albums of the Beatles, interspersed with film clips and commercials from the six or seven years of Beatlemania.

Professor Pana’s observation was spot-on: “It was like a facelift.” Those musical geniuses did have the audience rocking, from “I want to hold your hand” to the later ones from Rubber Soul, moving even those in the audience too young to KNOW to their feet.

I was thinking back to that day in the spring of 1964 when I was visiting my then fiancée at a fraternity party when one of my brothers said, “You’ve got to hear this group.” The song was, “I want to hold your hand,” and fifty years later, Carolyn, I still want to hold your hand. Happy Mum’s Day, Mrs. Hoyt. And the other mums reading this blog.